You can’t spend the same dollar twice.

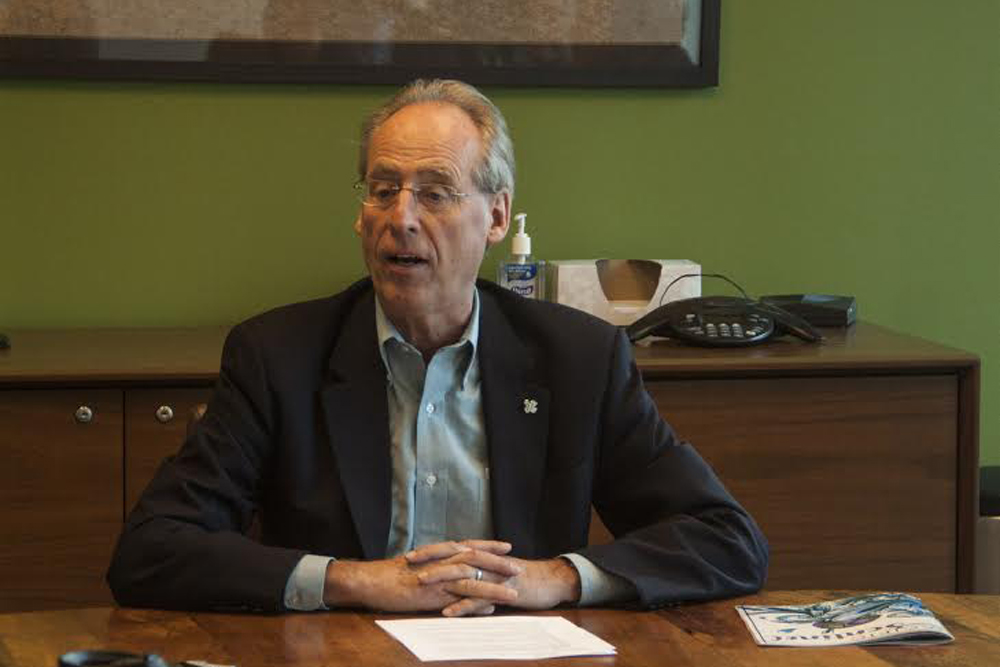

Portland State President Wim Wiewel pondered this conundrum while discussing a proposed tuition tax he hopes will reduce the cost of attendance for students with financial need. Wiewel outlined the upcoming legislation during a January 15 press conference; the ballot will be formally named in early February.

The proposed tuition tax would affect businesses in Washington, Multnomah and Clackamas counties. If approved, the ballot would require businesses in the tri-county area to pay one-tenth of a percent (0.001) of their overall payroll expenditure. For companies with multi-billion dollar payroll expenses, the tax would require multi-million dollar contributions annually. A company with an annual payroll expenditure of $500,000 would pay $500 under the proposed legislation.

On December 10, the PSU Board of Trustees approved a resolution to move the ballot measure forward. In addition to the tri-county tax measure, the university will continue to seek state support from the Legislature. Other plans for increased funding include targeted recruitment of out-of-state and international students, a philanthropy campaign organized by the PSU Foundation and initiatives that would allow students to earn their degrees more efficiently.

“We’re still going to have tuition, we’re still going to have to raise tuition,” Wiewel said. “We’re gonna use this to give scholarships to reduce the burden of tuition, but I don’t [want] anybody to think that somehow now we’re not going to have to raise tuition.”

According to Wiewel, without increased funding from the state it is impossible to answer the demands for lower tuition and higher faculty salaries.

The president also contested complaints that his salary significantly impacts tuition costs. He pointed out that reducing his earnings would do little to affect the $180 million PSU currently collects in tuition.

“[Roughly] two-thirds of our revenue is tuition and two-thirds of our expenditures are salaries,” Wiewel said.

70 percent of PSU students received financial aid for the 2014-15 academic year, mostly in the form of loans. Due to the low funds available for institutional scholarships — about $3 million — PSU students who qualified for financial aid this year still had $151 million of unmet need.

Wiewel estimates that the payroll tax for tuition would contribute $35 million for the PSU institutional funds. Half of this money would be used to award need-based scholarships and the other half would be used to hire student support staff, such as advisers and financial aid counselors.

The tax would not directly affect community colleges in the tri-county area. PSU Director of Communications Scott Ghallager explained that institutions like Portland Community College will still benefit from the increased funds due to the large number of community college transfers into PSU each year.

“As of fall term we have about 4,400 transfers from PCC. So this money is helping benefit us, but also benefitting them,” Gallagher said.

When contacted, PCC Media Relations Specialist James Hill stated that the college does not have a position on the proposed payroll tax, due to the limited details available this early in the planning stages.

Wiewel stated that the proposed ballot measure has received support from community groups, but some hesitance from the business community.

“There are two reasons,” he said. “One is that some business people simply do not like the idea of more taxes; many others in the business community are supportive of taxes for, you know, the right things.”

In January, Wiewel met with the Portland Business Alliance regarding the upcoming legislation. At the time of press, the PBA had not returned any calls for comment.

Another challenge facing the tax proposal is a competing ballot measure from the Better Oregon coalition. This ballot measure would amend the current Oregon sales tax legislation and require businesses with over $25 million in sales to pay a base tax rate of $30,001, plus 2.5 percent of all sales exceeding $25 million.

“Certainly for our purposes it would be easier if the other proposal wasn’t on the ballot,” Wiewel said.

Wiewel said the choice to pursue a payroll tax for the 2016 ballot has a lot to do with presidential elections.

“That’s when you get the largest electorate of young people who are most likely to care about scholarships and tuition assistance,” he said.

The ballot measure will be formally named in February, after which a citizen’s committee will be responsible for collecting 38,000 valid signatures in order to file the ballot measure for voting in November.

Once the ballot measure has been formally named, Wiewel will no longer be permitted to advocate for its support. PSU faculty and staff may promote the proposed tax, but only during non-working hours.

“This really is, I think, our most significant initiative for the coming year, and in many ways, one might say perhaps the most significant initiative of my presidency,” Wiewel said.