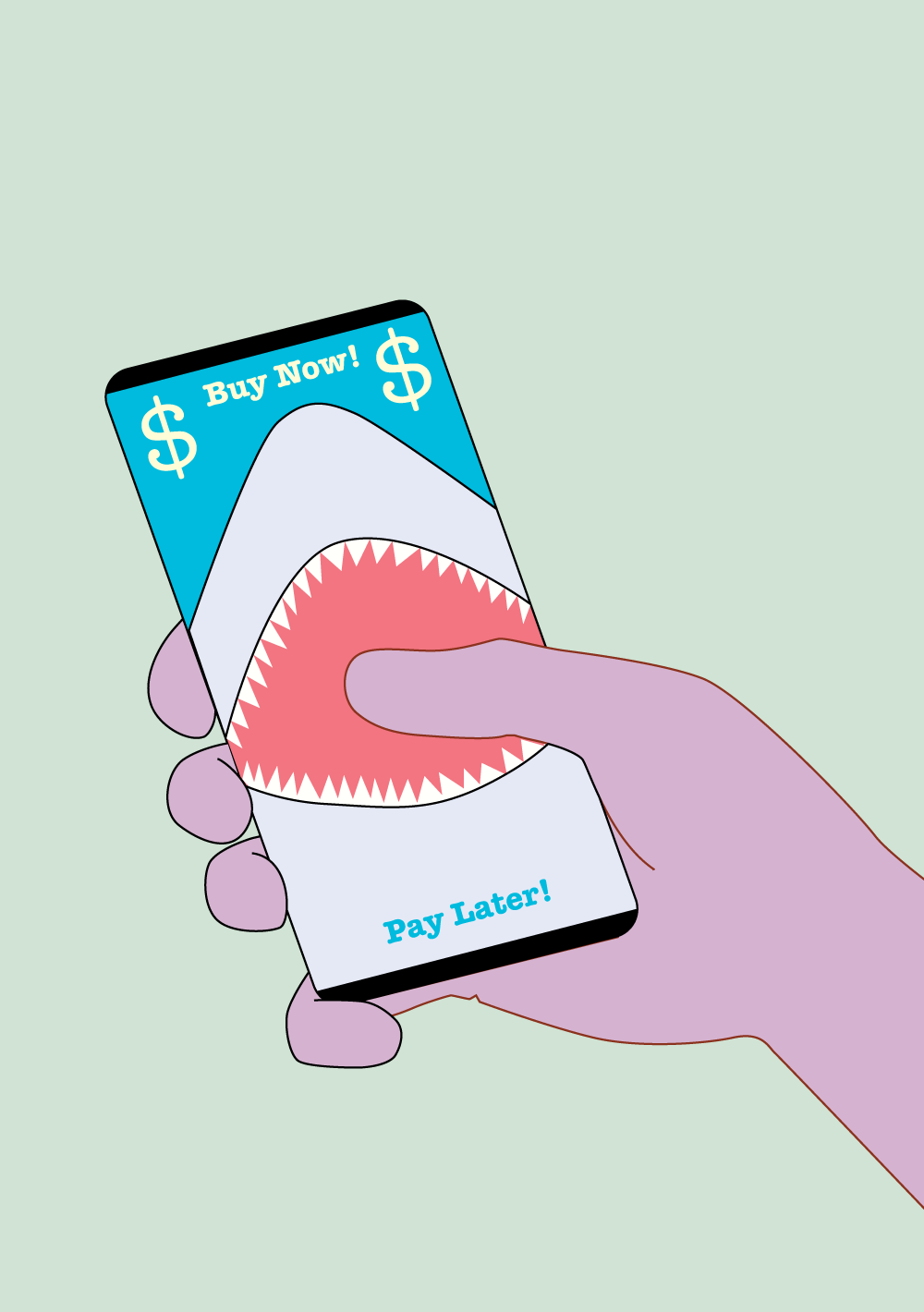

Loan companies, regardless of the type—no-interest, small-scale loan programs like Afterpay and Affirm—are still sharks.

Credit cards and small-scale loans are nothing new. Afterpay and Affirm, however, are newer, friendlier and better-branded versions. These companies have crept into the lives of the otherwise financially disciplined or those who don’t have the discipline to say no. They prey on the vulnerabilities of us all, and there are no prerequisites to plunging yourself in subtle financial debt over a pair of designer shoes.

The total credit card debt in the United States is over $830 billion as of 2017, according to the Center of Microeconomic Data. In addition to this, research shows even when not paying interest, people spend 30% more when using credit as opposed to what they spend when coughing up cold, hard cash.

Though their intention is ultimately the same, they operate in different ways. It works like a mini credit card or loan. With Afterpay, you buy a product or service, then pay for it in four installments. Affirm is a bit different, because once purchasing products you have the option to pay for them in either three, six or 12 month installments. Granted, these options are much more digestible than footing the bill all at once. Instead of rationalizing—and hopefully assessing—the underlying price of this product, you begin to rationalize the installment cost instead.

Afterpay recently capped their late fees at a maximum of $68 per order and has a $1500 maximum loan limit. Affirm has no late fees associated with their orders, and each loan application is reviewed by analyzing factors such as your social network profiles and phone usage to determine your true “online life.”

According to their financial report, most of Afterpay’s revenue comes from charging retailers. The company generated more than $37.1 million in fees from retailers in the first half of the 2018 financial year, with an additional $10.8 million in late fees. Some customers couldn’t make their repayments, leading to $6.8 million in unpaid debt being written off by the company.

Retailers appear to like the “buy now, pay later” service because it makes it easier for shoppers to buy their products, according to a consumer advocacy publication Choice. This service appeals to a young demographic. The first half of 2018 financials claim people aged between 18 to 34 make up 67% of Afterpay’s customer base.

Affirm has similar revenue—the only difference being that their business model relies more on their funding efforts and the cumulative interest rates by customers.

Overall, the consumer element of both business model is predicated on you messing this up eventually.

The current demographic that holds the most credit card-related debt is ages 35–65, according to the Credit Snapshot of 2017. Despite the higher age demographic that holds majority of the debt, these new companies—whether intentionally or not—target millennials and Gen Z.

Since many millennials and younger Gen Z-ers are no longer applying for credit cards, according to a survey conducted by Bankrate, the idea of payment installments with little to no strings attached is almost irresistible. The majority of the companies and services they offer are fashion related and other popular retail stores. They don’t offer their services for life essential companies or even healthcare.

These new payment options are a massive slippery slope to funding a lifestyle you can’t really afford. Whatever reasoning or financial responsibility you may hold, it does not defeat the fact you are spending money you don’t have.

If you can’t afford to pay in full now, you probably can’t afford it, and you probably don’t need it.

“So if I can’t afford to buy it now, I shouldn’t get it ?”

How about your mobile phone bill, power bill and your mortgage? Did you pay for it up front ? 90% of Afterpay users are on debit cards.