When I hear about inflation, all I want to think about is inflating my bike tires full of air and going on a nice ride on a breezy April afternoon. But recently, U.S. inflation has risen 8.5%—the highest pace in 40 years. The last time we saw such dire statistics was in 1981.

With the pricing of gas, food and pretty much everything rising, the supply chain disruptions coupled with labor shortages related to the pandemic still seem bizarre when all of these big corporations are marking record profits. It simply seems like a slap in the face seeing that large businesses are benefiting from the pandemic and the war Russia has raged on Ukraine.

The future looks bleak if inflation keeps going up for us everyday citizens. Should I pay for food or gas? Such decisions thwart us faster than we realize. The financial apocalypse seems to be around the corner.

Even more problematic than rising prices is how these corporations use it to their advantage with market manipulation.

Say, for instance, prices for toilet paper skyrocket, but my local grocery only distributes 75 bundles at a high price. With a first-come-first-serve mentality, these corporations can easily shift gears and profit from the increased demand for said product. By limiting the supply but increasing the demand, it’s quite hard to regulate. It seems to fall into a gray area.

As another example, suppose that a Transformers toy is suddenly in demand because other toy manufacturers went out of business, but only Target and Walmart get to carry the product. Target may charge $75 for your limited edition Optimus Prime figure, while Walmart goes above and beyond and charges $100. If Target only has a week’s worth of inventory of this toy, but Walmart has an entire box of them, then Target’s box will sell out quickly and consumers will be forced to buy from Walmart at the increased price. You can see the pattern here.

There should be some sort of regulation, but currently there’s none at all. In normal times, there would be no way in hell these companies would be able to charge $100 for my Optimus Prime. This inflation doesn’t just affect collectible toys and consumer goods—the same applies to gas prices, food and really everything.

When a delay happens, there’s an opportunity for companies to explain to customers why prices are being raised. Issues like distribution or delivery that necessitate the current cost increase can, of course, be justified—but at what point does the line blur? At what point do consumers have to make the call to not get the product that they want, or even need? Inflation affects all of our lives to a considerable degree, and the point that it has gotten to is inexcusable.

We all know that the global supply chain has been disrupted. Last November, President Joe Biden spoke about energy costs, and stated he would begin an investigation led by the Federal Trade Commission to tackle the potential market manipulation at play.

With the President stepping in, how would companies be penalized for manipulating markets or price gouging? A slap on the wrist? A firm warning? Permanent closure? Only time will tell.

With a possible recession on the rise, perhaps we need to approach this issue differently than before. Transparency amongst leaders in business might just be the solution we need to halt this market manipulation.

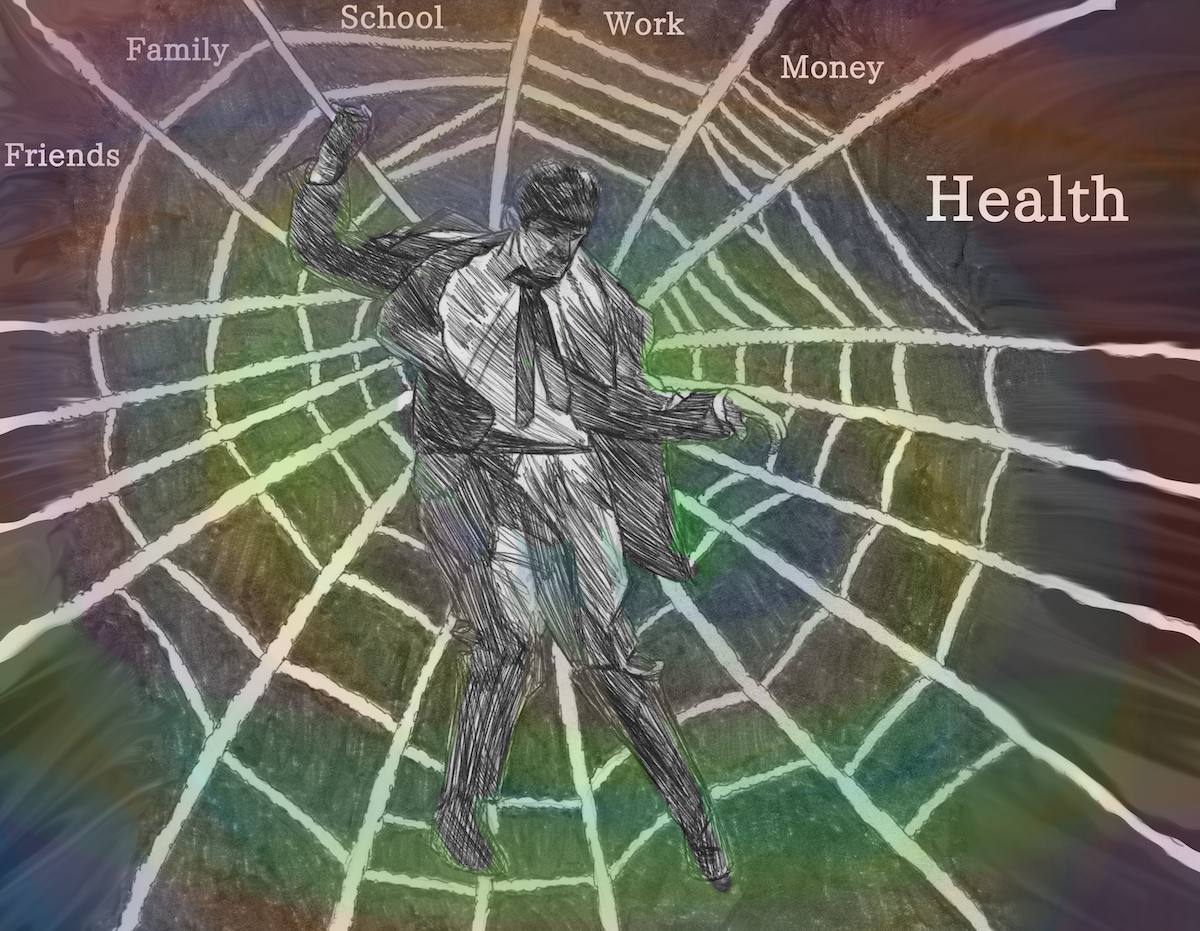

A balance needs to be set in place, so that we won’t be making these hard financial decisions, juggling which of our basic needs and desires we have to live without.

What does the future have in store—pun intended—for us?