Divesting university funds from any certain companies, as resolved by Associated Students of Portland State University to address concerns about ethical and responsible consumerism, does not comply with the policy and provisions stipulated by Oregon State Treasury for assets held in the Public University Fund. The state treasurer invests on behalf of the six Oregon public universities through the PUF.

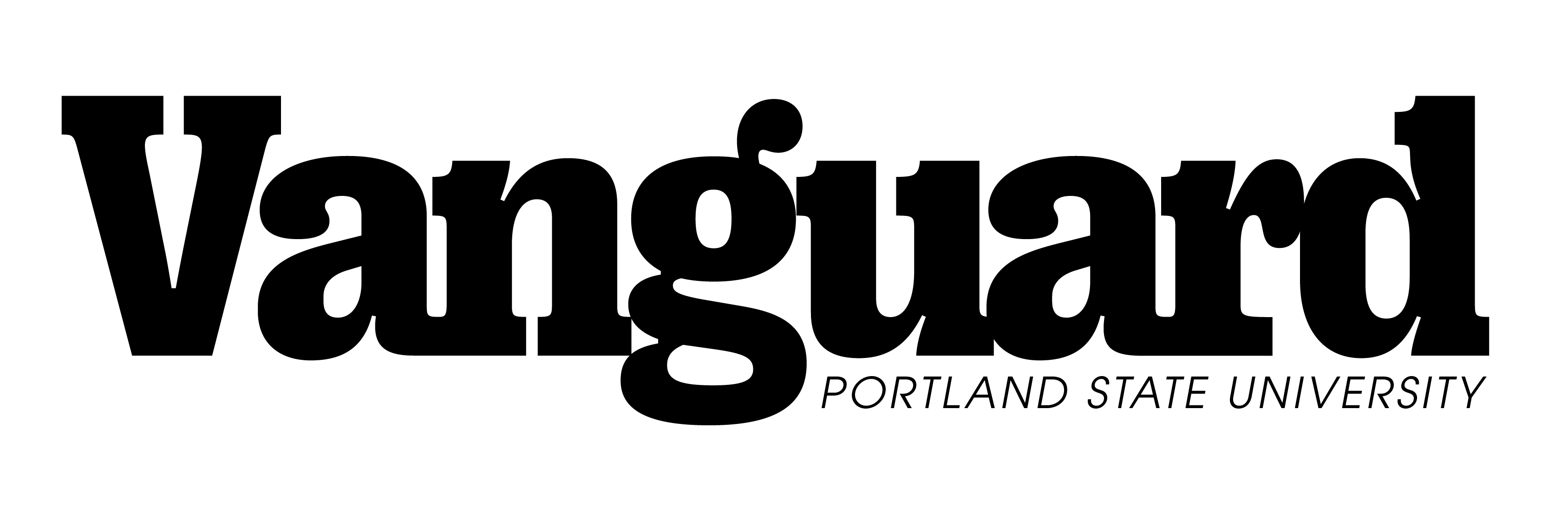

On Oct. 10, 2016, ASPSU read its “Resolution to Recommend Divestment from Companies Involved in Israeli Military Occupation.” After the reading, members of the audience were invited to speak. The voices in favor of and against the resolution were equally passionate.

The resolution specified four companies: Caterpillar Inc., Motorola Solutions, Hewlett Packard Enterprises, HP Inc. and G4S. ASPSU claimed they had no knowledge of whether or not PSU held investments in any of the specified companies.

As of Sept. 30, 2016, the PUF held assets worth $486.5 million. None of those assets were invested in G4S, HP Inc. or Hewlett Packard Enterprises. At that time the PUF had invested $1,284,683 in Caterpillar Inc.

On Oct. 24, 2016, after members of the audience once again passionately stated their pros and cons, ASPSU overwhelmingly passed the resolution calling on PSU to divest from companies found to profit from human rights violations against Palestinian civilians by the Israeli government.

Two days later PSU President Wim Wiewel issued a statement that he did not support the resolution: “We place a high value on the cultures, religions and political views that make up the rich mosaic of our community. I believe this resolution would divide us at a time when we are striving to nurture our diverse and inclusive campus environment.”

ASPSU President Liela Forbes explained that the resolution was not founded on an anti-Semitic perspective. “It is a joint perspective of students from varying walks of life and varying experiences who want to make a change on campus they feel is ethically and morally responsible,” Forbes said.

Wiewel wrote, “The resolution follows a recommendation from the Boycott, Divestment and Sanctions movement, which was started in 2005 by pro-Palestinian organizations seeking international pressure on Israel to end settlements in occupied territories and other measures. The BDS resolution calls for divestment from companies such as Caterpillar and Hewlett Packard.”

According to the BDS website, “[It] works to end international support for Israel’s oppression of Palestinians and pressure Israel to comply with international law.”

“This is not a BDS resolution,” Forbes said. “It is not affiliated with a larger boycott divestment sanctions movement. It is a resolution brought to our student government from students in our community asking to facilitate a divestment from companies complicit and profiting by this occupation.”

Wiewel’s statement claimed, “[PSU] does not invest its funds. We are one of six Oregon public universities whose funds are deposited in the Public University Fund managed by the Oregon State Treasurer, who is prohibited by law from holding any equity investments. Thus, the resolution has no practical effect and is intended as a political statement.”

Forbes disagreed, stating, “I think that there are plenty of examples of divestment opportunities that have happened in civil rights movements and in the clean energy and climate change struggle. If we can start that movement somewhere, then we can start incentivizing those companies to withdraw their participation because they recognize it as a risky financial investment.”

ASPSU would like PSU, the city and the state to be involved in divestment.

The PUF, which operates under OST requirements, has designated fixed income investment officers and is managed by the Oregon Investment Council, who have “full discretionary power to direct the investment, exchange, liquidation and reinvestment” of the assets, according to INV 405. In compliance with House Bill 4018, the PUF is under the responsibility of an agreed-upon, designated, participating public university, which is Oregon State University.

“Individual universities do not have their own distinct sets of policies for the dollars they elect to deposit in the Public University Fund,” said James Sinks, director of communications and stakeholder relations for the OST executive division, via email. “In a way, it is like a mutual fund. You can elect to deposit your money, or not, but you don’t pick and choose the exact securities that are helping the mutual fund generate a return.”

“From an academic and financial standpoint, divestment raises risk profile and also can unbalance a portfolio because it can lead to uneven market exposure and too much concentration in certain sectors,” Sinks said. “That can result in lower performance over time. Divestment also does not create incentive for a company to change, compared to engagement by shareholders and, to a lesser degree, bondholders.”

ASPSU is concerned about ethical and responsible consumerism.

“We were aware going into this that the university invests in the [PUF],” Forbes said. “That doesn’t mean we as students can’t weigh in or try and make a dialog around an issue that we’re funding. We would like the administration to hear us on this. We would like to build connections with the administration to understand why this is an important issue for students. We’re not the only aspect of Portland at this time that’s divesting from doing business with these entities.”

In recognition of everyone’s voices, Forbes wanted to thank each entity and individual, whether for or against, who participated in the decision.

“It takes a lot to be able to stand up with conviction for what you believe in,” Forbes said.

Anyone interested in any ASPSU initiative is invited to contact the organization. The ASPSU is always looking for volunteers, and they offer internships. Senate meetings are open to the public and convene every other Monday from 5–8 p.m.