The COVID-19 pandemic has proven minimum wage does not pay enough to cover the costs of daily living.

Since early March, the COVID-19 pandemic has caused unemployment to skyrocket around the United States. Many people who were laid off six months ago are continuing to receive unemployment because their jobs are not safe to open yet. Some people who have been unemployed since March are still awaiting their first unemployment checks. Worst of all, entry level jobs have open positions that are not being filled because so many people are awaiting their jobs to open back up and do not want to climb the ladder to receive what they had been earning before.

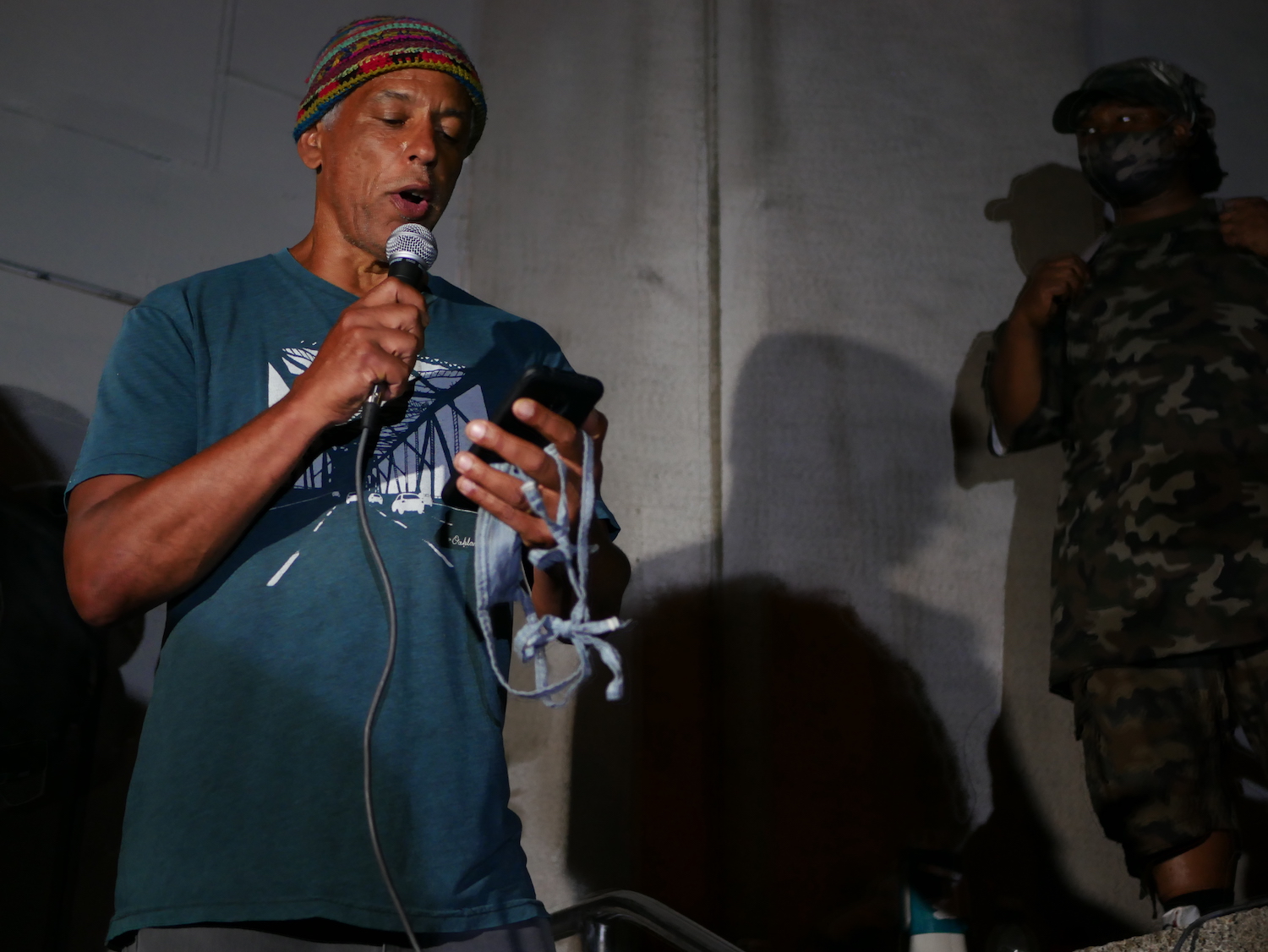

Zac Keyes, a former Oregon resident, was laid off from his job as a computer numerical controlled machinist this past July, after working there for nine months. He was in the industry for six years and went to school for two years to be promoted from a CNC operator. For him, searching for a job outside of his industry is not a feasible option.

“I really don’t want to be on unemployment,” Keyes said. “I feel better about myself and am happier when I work for my own money. “However, while so much of the economy is shut down, either I need to change my field of work or collect unemployment till I can find something in my own industry. What makes it complicated is I make more on unemployment than I would if I changed industries and had to start working my way up again.”

Keyes is an example of a typical unemployed middle-class American right now. While there are entry level jobs available, people like him feel waiting for jobs in their industry to open up again is their best opportunity—especially when unemployment is paying them more than an entry level job would. This is part of the problem causing widespread unemployment across the U.S. It’s not that there aren’t jobs available, it’s that there aren’t jobs that can sustain the typical American’s daily expenses.

“While an adult, I’ve gone to college twice while working a full-time job so I could afford to pay my bills,” Keyes said. “Now I’ve got a family and a house payment. I’d have to take two full-time entry level jobs to afford cost of living. At that rate, my family life and work performance would suffer and I’d be stuck in a loop. Best-case scenario, it could still take years to get my feet back under me. That being said, once unemployment is done if I haven’t found something that’s what I’ll have to do. It’s kind of stressful.”

This is not even mentioning unemployment isn’t covering the costs of an average middle-class American. According to Keyes, he’s taken “probably around $250” out of savings. “It’s a bit hard to say for sure because I set money aside for projects, and we did do some elective spending,” Keyes said.

Unemployment could start running out as soon as 2021, depending on individual qualifications.

Keyes noted if he had not set aside a large sum of money after recently selling his house, things would be much worse for him and his family.

Although Keyes said he used money for projects/elective spending, it is still significant that he is having to do this. If he was working a job in his industry, he would be making the same spending choices without jeopardizing his savings.

For a lot of Americans, unemployment is not a motivator, regardless of whether they have a job they’re waiting on to reopen. Even though unemployment is meant to be a temporary income, it doesn’t teach people how to get jobs, nor does it offer resources to do so.

“It’s nice that unemployment exists, but it really isn’t providing me any resources to get back to work,” Keyes said. “I’d suggest not passing any viable opportunity for work. Dedicate some time looking for employment or educational opportunities either in your field or one you’d be interested in. And hopefully either the market recovers or the government provides more relief soon. I honestly don’t see jobs making less than 18 dollars an hour as remotely viable in a single-income home.”

Keyes recently moved from Utah to Alaska and just had a job interview. Although it is outside his preferred industry, this potential occupation pays above minimum wage and will cover the cost of his children’s schooling while he waits on the economy to open back up.