Paying for college can be challenging for students from all walks of life, but students who are undocumented or enrolled in the Deferred Action for Childhood Arrivals program face a unique set of obstacles. DACA students do not qualify for federal financial aid and are sometimes required to pay nonresident tuition rates, even in their state of residence. On top of this, the impending cancellation of DACA means that some students may face the revocation of their work permits, further limiting their financial options.

“There’s a lot of uncertainty, and I think that’s what a lot of students in this situation are feeling right now,” said Emanuel Magaña, Latinx Student Services coordinator at Portland State. “They don’t really know what to expect.” Despite these barriers, financial aid and scholarship resources do exist for undocumented and DACA students.

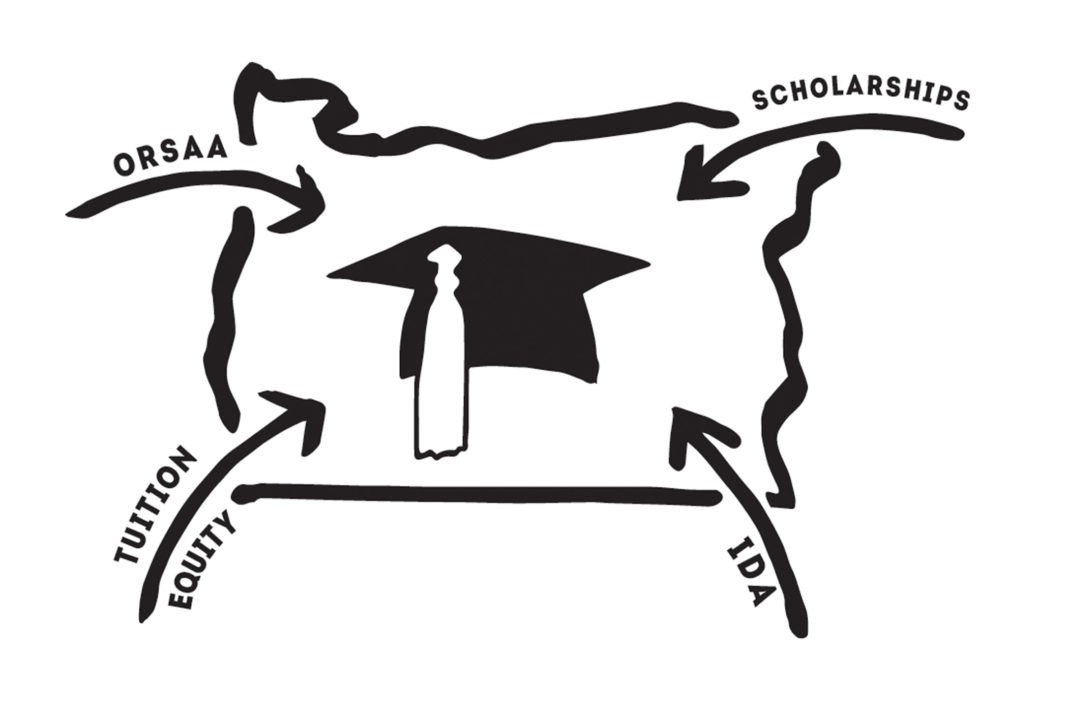

Tuition equity

Tuition equity policies, like the one signed into law in Oregon by Governor John Kitzhaber in 2013, allow undocumented and DACA students who meet certain criteria to qualify for in-state tuition rates despite not being legal Oregon residents. These reduced rates can make a difference in the overall cost of attendance.

For the 2017–18 academic year, base tuition rates for nonresident students are more than three times that of residents. In order to be eligible for tuition equity, prospective students must submit the Affidavit and Request for Exemption from Nonresident Tuition and Fees in addition to the standard admissions application.

Oregon Student Aid Application

Although they do not have access to the federal financial aid through the Free Application for Federal Student Aid, undocumented and DACA students are eligible for aid through the state of Oregon. The ORSAA, designed as an alternative to the FAFSA, allows undocumented students to apply for scholarships and grants from the state, including the Oregon Opportunity Grant.

Individual Development Account programs

Another way students without access to federal financial aid can save money for school is through an Individual Development Account program, which is a matched savings account designed to allow people with limited assets to save money for a specific goal. When that goal has been reached, the savings are matched using state, federal, or grant funds, allowing the saver to double or sometimes triple their savings. This strategy requires some amount of monthly income and time for savings to grow. Magaña particularly recommends it for students who are actively saving money before beginning school, taking time off from school, and those who work. Students interested in IDA programs can learn more through the local nonprofit Casa of Oregon.

Scholarship opportunities

In addition to the wide variety of scholarships offered through PSU, many private scholarships directly cater to undocumented and DACA students. My Undocumented Life, a website dedicated to resources for undocumented immigrants, features a regularly updated list of scholarships for undocumented students. Another good resource is the DREAMer’s RoadMap mobile app, free for Apple and Android.

Although these resources can be vital to helping them pursue their education, Magaña explained, undocumented and DACA students still face serious disadvantages. “I think sometimes there’s this misconception that [undocumented students] are here to take funds away from students…but the fact of the matter is that they had to get here, to earn their spot, just like every other student,” he said. “They should get the same opportunities that any other student gets that’s working to get through their education. And not only that but I think it’s an investment…it really is an investment in the future.”

I am a fourth-year student in the University Honors College studying political science and Arabic. I started with Vanguard in August 2017 as a reporter for the international section before becoming international editor at the beginning of this year. I have been working with the news team since spring 2018. As news editor, I am responsible for curating, editing and reporting on content relating to the goings-on of PSU and its surrounding area while working with a team of reporters to accurately and responsibly inform the campus community.